Stunning Tips About How To Draw Volatility Smile

Since you're asking, i'll assume you're trying to draw a volatility smile over strike prices, log moneyness, or some similar.

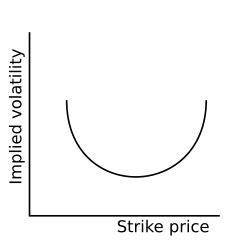

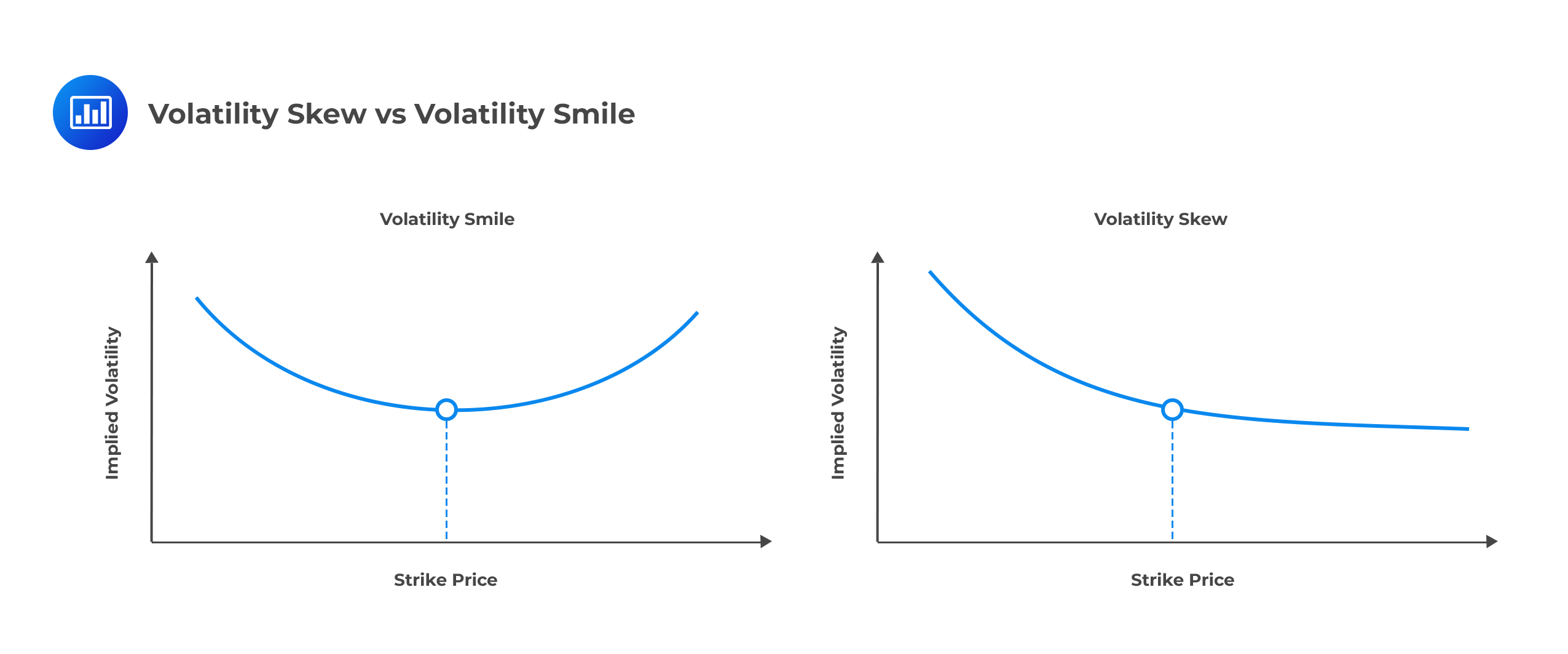

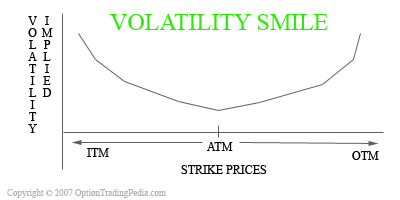

How to draw volatility smile. This smile shape is formed because the market establishes higher. Obviously, each stock should possess just one volatility. A volatility smile is a geographical pattern of implied volatility for a series of options that has the same expiration date.

This curve is called the volatility smile. Implied volatility smiles involve the plotting of strike prices and implied volatility of a bunch of different options on a graph with levels of implied volatility and different strike. Volatility smiles are implied volatility patterns that arise in pricing financial options.

Usually, the implied volatility values form a convex curve along the strike prices. However, when estimating implied volatility, different strike prices might offer us different implied volatilities. A volatility smirk is found by plotting exactly the same data points, except that when the curve is created, it will be weighted more to one side.

This gives the appearance of a. We also figure out how to use the black scholes model to calculate implied volatility, what are its. To complete the logic above we will use.

1 first off, volatility smiles are often drawn over a delta space. Implied volatility = argmin σ∈(0,6] |v market − v bs(s,k,t,r,σ)| implied volatility = arg min σ ∈ ( 0, 6] | v m a r k e t − v b s ( s, k, t, r, σ) |. Building the surface in excel.

In this video we discuss the concept of volatility smile.

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

:max_bytes(150000):strip_icc()/VolatilitySkew2-17197b230fb84ea9ae62955e956ffe0c.png)

/VolatilitySkew2-17197b230fb84ea9ae62955e956ffe0c.png)