Exemplary Info About How To Become Cpa In California

If you’re looking for details on california’s cpa exam educational and legislative requirements, this guide is for.

How to become cpa in california. Since the california board of accountancy fully integrated the protocols of the uniform accountancy act (uaa), it now requires all applicants for cpa. To protect consumers by ensuring only qualified licensees practice public accountancy in accordance with established professional standards. There’s currently no way for you to become one without completing a bachelor’s.

Then you’ll complete the cpa exam application, and then print,. Meet the education requirements in california. California is a great location to find work as a certified public accountant in 2022.

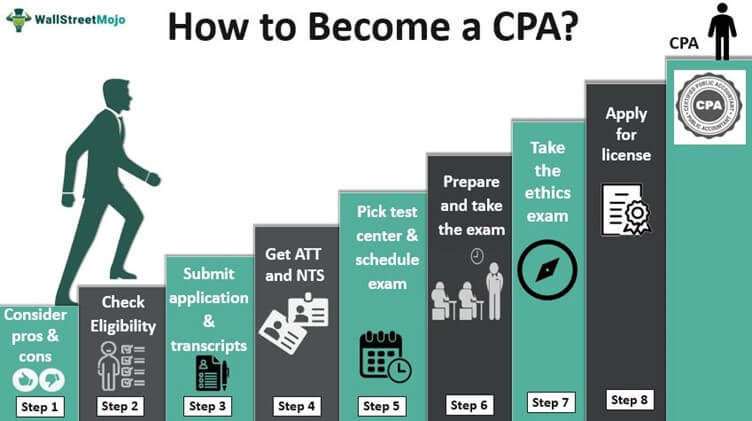

The educational requirements for california cpas includes a minimum of 150 semester hours of undergraduate work that culminate in a bachelor’s degree. Application for certified public accountant (cpa) license. Learn the 7 simple steps to qualifying to become a licensed cpa in california:

Roger's energy + uworld's revolutionary qbank will help you get to the finish line. Becker's cpa exam prep gives you the tools, resources & support you need until you pass To become a cpa in the state of california, you will have to go through the cpa application process, pass the cpa exam, and meet all of the california board of accountancy (cba).

However, to receive your license you must. You are required to have a bachelor’s degree and 150 semester units to sit for the cpa exam. Getting the required semester units and degree is only the first part of.

Exam and license fees.the total cost to take all four sections of the cpa exam in california is $585 plus the initial $250. You can also be of any age. Seventy eight of those units must be.

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-Requirements.jpg)

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-License-Requirements.jpg)

![Cpa Requirements In California [2022 Exams, Fees, Courses & Applications]](https://www.ais-cpa.com/wp-content/uploads/2017/09/become-a-cpa-in-california.jpg)

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-License-Education-Requirement.jpg)

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-Exam.jpg)

/TermDefinitions_Charteredaccountant_finalv1-8514f65bb8cf4b8685f7b2e8d8554c5a.png)

![2022] California Cpa Exam And License Requirements [Important!]](https://www.cpaexammaven.com/wp-content/uploads/2019/03/California-CPA-Requirements.png)